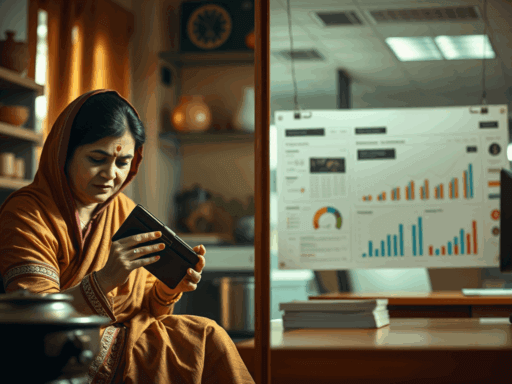

Namaste, pyaare dosto! Kya haal hain? Aaj ek aise topic par baat karte hain jo har Indian household ki kahaani hai. Hum sabki life mein ek time aata hai jab humein lagta hai ki yaar, paisa bachane ka secret kya hai? Kaise bachayein ye rupaye jo jeb mein aate hi gayab ho jaate hain? Aur iss sawaal ka jawab dene ke liye, hamaare paas do sabse bade contenders hain: ek taraf hamaari pyaari mummy ka woh ‘gupt’ batua, aur doosri taraf, thoda complicated sa lagne wala, Mutual Funds. Toh chalo, aaj dekhte hain ki kaun jeetega iss ‘Saving Ka Mahayuddh’ mein!

Mummy Ka Batua: The Original ‘Secret’ Vault!

Yaad hai woh din jab hum chote the, aur kabhi koi rishtedaar paise dekar jaate the? Agle hi pal mummy ka “Laao, mein rakh leti hoon” waala dialogue aata tha. Aur woh paise kahan jaate the? Kisi ko nahi pata! Woh the Mummy Ke Batue ke ‘secret chambers’.

Mummy Ke Batue Ke Fayde:

- Instant Access: Jab bhi zaroorat padi, bas thodi minnatein karo, aur mil gaye paise! No forms, no waiting period.

- Emotional Security: Ek alag hi sukoon milta tha yeh soch kar ki emergency mein mummy hai na sambhaalne ke liye. Maa hai na, sab manage kar legi.

- No Paperwork, No Tax Hassles: Zero documentation, zero financial jargon. Simple, sweet, aur desi!

- Inflation-Proof (for her!): Mummy ko inflation ki tension nahi hoti thi, unke liye toh bas “bachat” important thi.

Lekin, dosto, har picture ki do sides hoti hain. Mummy ka batua, jitna comforting lagta hai, utna hi risky bhi ho sakta hai. Agar aap bhi un logon mein se hain jinke paise aate hi udanchoo ho jaate hain, toh pehle yahan click karke dekho: Paisa Aate Hi Kharch? Bachat Ka ‘Desi’ Hack Seekho! Tumhari Jeb Bhi Khush, Tum Bhi! – shayad mummy ke batue se pehle, basic bachat ka gyaan mil jaaye!

Mummy Ke Batue Ke Nuksaan:

- Zero Growth: Aapke paise, jo chaawal ke dabbe mein ya almari ke peeche chhupkar baithe hain, woh bade nahi honge. Ulta, inflation unki purchasing power kam kar degi. Ek lakh aaj ki value, 10 saal baad ek lakh nahi rahegi.

- Security Risk: Chori ka dar. Aur agar mummy ko yaad na raha ki kahan rakhe the, toh gaya kaam se! (Hahah, hota hai yaar!)

- Limited Funds: Batue mein kitne paise honge? Ek limit tak hi na. Bade financial goals ke liye yeh strategy kaam nahi aayegi.

Mutual Funds: Naya Zamana, Nayi Soch Ka Paisa Bachane Ka Secret

Ab aate hain modern zamane ke ‘financial guru’ – Mutual Funds par. “Mutual Funds Sahi Hai!” yeh toh har TV ad mein sunte hain. Lekin kya sach mein yeh hum middle-class logon ke liye paisa bachane ka secret hai? Chalo dekhte hain.

Mutual Funds Ke Fayde:

- Professional Management: Aapka paisa experts handle karte hain. Unko pata hai kab kya khareedna hai, kab kya bechna hai. Aapko stock market ki har din ki tension lene ki zaroorat nahi.

- Diversification: Aapka paisa alag-alag companies mein invest hota hai. Toh agar ek company doob bhi gayi, toh baaki aapko bacha lenge. “Don’t put all your eggs in one basket” – yehi principle hai.

- Power of Compounding: Yeh cheez, dosto, jaadu hai! Aapka paisa, uske upar mila hua return, aur phir uss return par bhi return! Long-term mein yeh aapko Paisewala Banne Ka Asli Jugaad: Jo Koi Nahi Batayega! dikha sakta hai.

- Liquidity: Most equity mutual funds provide good liquidity, meaning you can redeem your money relatively easily when needed.

- Regulated: SEBI (Securities and Exchange Board of India) regulate karta hai, toh transparency aur investor protection rehta hai.

Mutual Funds Ke Nuksaan:

- Market Risk: “Mutual fund investments are subject to market risks.” Yeh disclaimer bina wajah nahi aata. Market upar neeche hota hai, toh aapke returns bhi.

- Need for Understanding: Thoda gyaan toh chahiye hota hai. Kaunsa fund, kaisa fund, equity ya debt? Beginners ke liye confusion ho sakti hai.

- Fees: Fund managers apna charge lete hain (Expense Ratio). Thoda sa amount aapke return se kam ho jaata hai.

Toh Kiska Palda Bhaari Hai: Mummy Ka Batua Ya Mutual Funds?

Yeh sawaal, dosto, “Biryani vs. Pizza” jaisa hai – dono apni jagah best hain! Sach kahu toh, paisa bachane ka secret kisi ek mein nahi, balki ek smart balance mein hai.

Short-term goals aur emergency funds ke liye: Mummy ka batua (ya uski modern version – Savings Account) best hai. Kuch paise liquid rakho, taaki unexpected kharchon ke liye haath na failane pade. Jaise, sudden doctor ka bill ya gaadi kharab ho gayi.

Long-term goals aur wealth creation ke liye: Mutual Funds ki taraf dekho. Agar aapka sapna hai Middle-Class Crorepati Banne Ka Jugaad: Sapna Ya Sach? Chalo Raaz Kholte Hain! toh yeh sirf batue se nahi hoga. Education funding, retirement planning, ghar kharidna – inn sab ke liye aapko growth chahiye, jo Mutual Funds provide kar sakte hain.

Hum Indians ki life mein bade-bade kharche aate hain, jaise shaadi! Aur uske liye bhi smart planning zaroori hai. Kya aapko pata hai ki Shaadi Mein Kharch Ya SIP Mein Invest? Smart Choice Kya Hai, Doston? Is sawaal ka jawab bhi aapko yahi milega.

### The Ultimate Paisa Bachane Ka Secret Formula:

1. Ek Emergency Fund Banaao: 3-6 mahine ke kharchon ke barabar paise, safe aur easily accessible jagah rakho (jaise bank saving account ya liquid funds). Yeh aapka “Mummy Ka Batua 2.0” hai.

2. Goals Set Karo: Apne financial goals define karo. Short-term, mid-term, long-term.

3. Invest Wisely: Apne goals aur risk tolerance ke hisaab se Mutual Funds mein invest karo, preferably through SIP (Systematic Investment Plan). Chote-chote amounts regular invest karte raho, market ki upar-neeche ki tension liye bina.

Mummy ke batue se humne bachat ki importance seekhi, uska emotional value samjha. Lekin modern duniya mein sirf bachat kaafi nahi. Hamein apne paise ko grow bhi karna hai, taaki woh future mein humaare liye kaam karein.

Toh dosto, paisa bachane ka secret koi ek cheez nahi hai. Yeh ek journey hai jismein hum purani wisdom aur naye tools ka combination use karte hain. Apni mummy ki bachat ki aadat ko salaam karo, aur saath hi saath, modern financial instruments ka gyaan bhi lo. Kyunki akhir mein, financial freedom sabko chahiye!